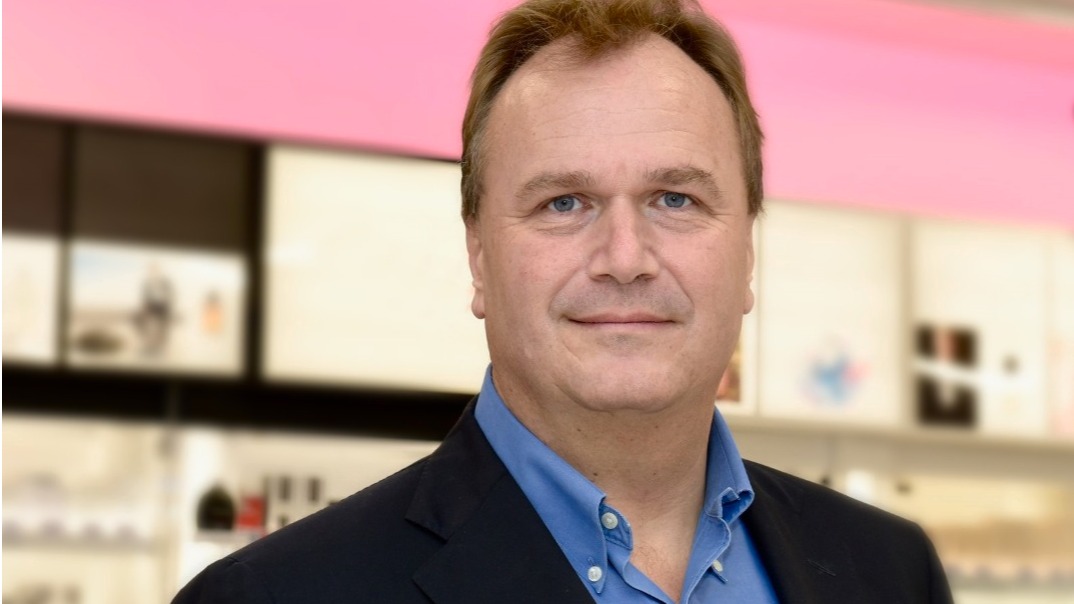

Sebastian James, the chief executive of Boots, Britain's largest high street pharmacy chain, is set to leave the company in November after a five-year tenure.

His departure comes as the retailer's American owner, Walgreens Boots Alliance (WBA), has once again shelved plans for a £5 billion sale or stock market listing of the business.

Sources close to the matter revealed that James has accepted a new role in the healthcare industry. Sky News, which first reported the news of James’ departure, subsequently reported that he will become the group chief executive of Veonet, a major European ophthalmology clinic chain owned by private equity firm PAI Partners and Canada's Ontario Teachers Pension Plan.

The announcement of James's exit is expected in the coming days, with WBA yet to name a successor. His departure coincides with Boots' 175th anniversary year and follows a period of strong performance for the retailer. The retailer’s most recent trading figures – published hours before James’s reported departure – show like-for-like sales growth of 6 per cent in retail and 5.8 per cent in pharmacy operations for the quarter ending May.

Commenting on what would be his final financial report as Boots boss, James said: “We are committed to delivering a fantastic experience for customers however they shop with us. I would like to thank our incredible team members for their continued hard work and ongoing commitment to deliver for our customers every day”.

James, who previously headed the electronics retailer Dixons (now Currys), has overseen a successful turnaround at Boots. An insider noted that the company has experienced market share growth for 13 consecutive quarters under his leadership.

The decision by WBA to retain ownership of Boots marks the second time in two years that plans for a sale or flotation have been abandoned. In 2022, only one formal offer was tabled during an auction process, with concerns about the global economy and challenges surrounding Boots' £8 billion pension scheme complicating potential deals.

Boots, which employs approximately 52,000 people across 1,900 stores in the UK, has faced its share of challenges in recent years under James. The COVID-19 pandemic led to 4,000 job cuts in 2020, and the company had previously earmarked about 200 stores for closure due to changing shopping habits.

Despite these hurdles, Boots remains a key contributor to WBA's operations. A spokesperson for the American healthcare giant stated, "While we believe there is significant interest in this business at the right time, Boots' growth, strategic strength and cash flow remain key contributors to Walgreens Boots Alliance."

Latest News

-

Tesco makes ‘significant strides’ on safety through body worn cameras

-

Flying Tiger Copenhagen appoints new group chief executive

-

Walgreens cuts over 600 jobs after buyout

-

Mango opens first store in Limerick as part of expansion plan

-

eBay and Etsy to buy Depop for $1.2bn

-

REWE opens automated fresh food facility to serve Berlin outlets

Beyond Channels: Redefining retail with Unified Commerce

This Retail Systems fireside chat with Nikki Baird, Vice President, Strategy & Product at Aptos will explore how unified commerce strategies enable retailers to tear down these barriers and unlock new levels of operational agility and customer satisfaction.

The future of self-checkout: Building a system that works for consumers and retailers

In this webinar, industry leaders discussed what the future of self-checkout looks like and how retailers can make the technology work for everyone.

© 2024 Perspective Publishing Privacy & Cookies

Recent Stories